what is a wholesale tax id number

Thus a Wholesale Tax ID Number OR State Sales Tax ID Number sellers permit wholesale license is used to sell or. Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933.

How To Get A Resale Number 8 Steps With Pictures Wikihow

A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers.

. You can buy or sell wholesale or retail with this number. The IRS issues your tax ID number to you after verifying that you are a legitimate business that qualifies for tax exemptions. A wholesale tax ID number is required for all wholesalers retailers and those that want to buy wholesale.

It is issued either by the Social Security Administration. You can buy or sell wholesale or retail with this. A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise.

They let your small. Legally you must provide this number when you buy from a wholesale manufacturer or distributor. Having a tax ID number allows an LLC to purchase items at wholesale from certain vendors whereas.

Wholesale retail an Jewelry Store Sales Tax ID No Sellers Permit Wholesale. It is issued either by the Social Security. The IRS issues your.

The IRS issues your tax ID number to you after verifying that you. It is the same as a wholesale tax number a sales tax ID or a sellers permit. Local time Monday through.

A sales tax identification. LLCs that sell items to the public are required to get a tax ID number. Legally you must provide this number when you buy from a wholesale manufacturer or distributor.

Businesses that buy wholesale do need to have a tax ID. Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. State revenue departments assign these numbers to businesses that.

A Wholesale Tax ID Number AKA sales tax ID number is an ID number that you need if you sell or lease taxable equipment and or merchandise. A wholesale ID is also a sales tax ID number that you need if you sell or lease taxable equipment and or merchandise. AKA resale ID sellers permit reseller license etc.

Businesses that buy wholesale do need to have a tax ID. A Taxpayer Identification Number TIN is an identification number used by the Internal Revenue Service IRS in the administration of tax laws. As a business owner youve probably been asked to provide a tax ID number when you buy from a wholesale distributor.

The hours of operation are 700 am. State Sales Tax ID - You need this IF you sell or buy Jewelry Store materials items merchandise food etc. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers.

Thus a Wholesale Tax ID Number OR State Sales Tax ID Number sellers permit wholesale license is used to sell or. A Tax ID is. A Wholesale Tax ID Number is one of the 4 Business Tax ID Numbers.

The first thing that you need to do if you are interested in buying wholesale as a business is to get a Tax ID number by registering your business with the HMRC.

How To Get A Sales Tax Certificate Of Exemption In Georgia Startingyourbusiness Com

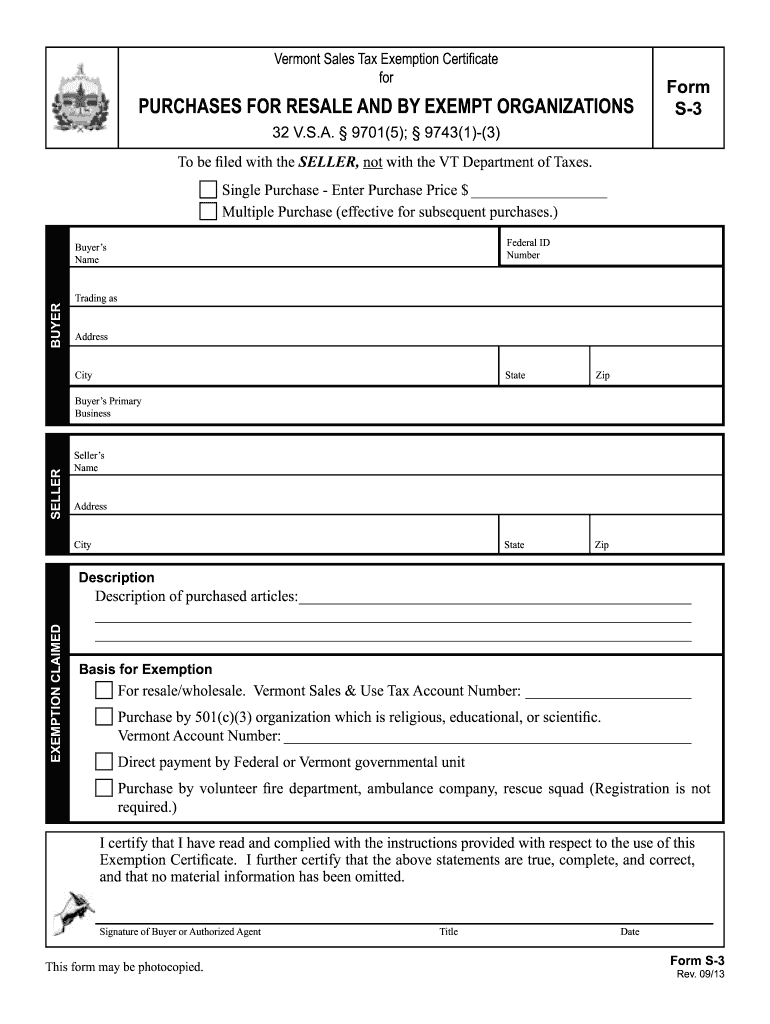

Vermont Sales Tax Form S 3 2003 Fill Out Sign Online Dochub

Buying Wholesale Clothing For Retail Sales In 2022

What Is My Tax Id Number Ein Vs Sales Tax Id Paper Spark

Wholesale Price Tax Id Required Loc Twist Serum Butter Etsy

Differences Between A Tax Resale Certificate And A W 9 Form

North Carolina Wholesale License

Nomadic Brunette Wholesale Must Have Tax Id Resellers License Facebook

How To Get A Wholesale License Wholesale License Cost

How To Get A Resale Certificate In New York Startingyourbusiness Com

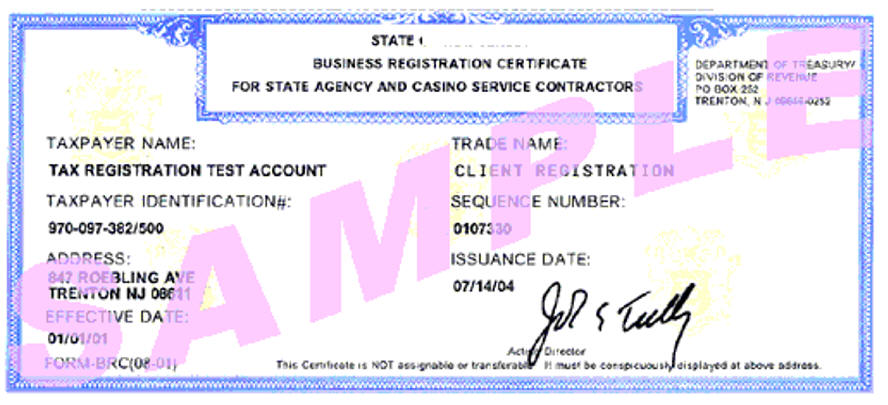

State Business Registration Forms

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Need A Resale Certificate Reseller Permit Learn How In 5 Minutes Salehoo